duluth mn restaurant sales tax

Inver Grove Heights MN Sales Tax Rate. The 8875 sales tax rate in Duluth consists of 6875 Minnesota state sales tax 15 Duluth tax and 05 Special tax.

Georgia Sales Tax Rates By City County 2022

The Minnesota sales tax rate is currently.

. Coon Rapids MN Sales Tax Rate. Lakeville MN Sales Tax Rate. SalesUse Tax Duluth City SalesUse Tax Duluth Tourism Additional Food Beverage Tax Duluth Tourism Lodging Excise Tax Duluth Tourism Additional Lodging Tax Total Tax 6875 05 15 225 11125 6875 25 05 15 225 13625 6875 05 15 30 11875 6875 05 15 30 25 14375 6875 05 15 8875 Collected by the State of MN 30 rooms or.

Job in Duluth - St. Depending on the zipcode the sales tax rate of duluth may vary from 8375 to 8875. The Duluth Minnesota sales tax is 838 consisting of 688 Minnesota state sales tax and 150 Duluth local sales taxesThe local sales tax consists of a 100 city sales tax and a 050 special district sales tax used to fund transportation districts local.

You owe use tax when Minnesota City of Duluth sales taxes are not charged on taxable items you buy whether you buy them in Minnesota or outside the state. Duluth Sales Tax Rates for 2022. 515 E 4th St.

The current total local sales tax rate in Duluth MN is 8875. The Duluth City Council took its first steps Monday night toward imposing a half-percent tax on hotel stays and sales of food and drinks served at city restaurants and bars. City Hall Room 120.

Lakeville MN Sales Tax Rate. Eden Prairie MN Sales Tax Rate. 2 A 225 excise tax on all taxable sales for businesses having yearly taxable sales of more than 100000.

Fast Easy Tax Solutions. 1 day agoThe Minnesota Department of Revenue says that two Lakeville restaurant owners face charges related to failing to pay sales tax. See reviews photos directions phone numbers and more for the best Tax Reporting Service in Duluth MN.

YEARS IN BUSINESS 218 727-0164. The dedicated tax is expected to generate about 725 million in 2022 the news. Cottage Grove MN Sales Tax Rate.

Income Tax Consultants. The County sales tax rate is. Duluth MN Sales Tax Rate.

Any food prepared by the seller or sold with. The Duluth City Council took its first steps Monday night toward imposing a half-percent tax on hotel stays and sales of food and drinks served at city restaurants and bars. Coon Rapids MN Sales Tax Rate.

A Duluth restaurant and its owners have pleaded guilty to tax fraud and will be required to pay nearly 300000 in uncollected sales taxes. Food and Beverage establishments must collect 225 for the Food and Beverage Tax. Fall - Tax Associate - PCS.

Burnsville MN Sales Tax Rate. Most food and drink sold by a food or bar establishment is taxable unless a specific exemption applies. For more information see Fact Sheet 164 Local Sales and Use Taxes.

The Duluth Sales Tax is collected by the merchant on all qualifying sales made within Duluth. 231000 in total sales at the restaurant and reported the. Banking and Finance Tax Law Tax Analyst.

Duluth in Minnesota has a tax rate of 838 for 2022 this includes the Minnesota Sales Tax Rate of 688 and Local Sales Tax Rates in Duluth totaling 15. For tax rates in other cities see Minnesota sales taxes by city and county. LINE 3 NET SALES.

Sales are reported and tax collected is remitted to the City of Duluth Treasurer. There is no applicable county tax. The laws of the State of Minnesota and the ordinances of the City of Duluth authorize the following taxes on bar and restaurant sales as described above.

1 A basic 15 sales and use tax. Eagan MN Sales Tax Rate. The Duluth Minnesota sales tax is 838 consisting of 688 Minnesota state sales tax and 150 Duluth local sales taxesThe local sales tax consists of a 100 city sales tax and a 050 special district sales tax used to fund transportation districts local attractions etc.

If however your purchases total more than 770 you must pay use tax on the entire amount. Sales Tax Service in Duluth MN. The December 2020 total local sales tax rate was also 8875.

The logs are located at 110 n. Duluth MN Sales Tax Rate. At a total sales tax rate of 7875 the total cost is 37756 2756 sales tax.

July 24 2019 page 1 of 3. The current total local sales tax rate in Duluth MN is 8875. This 15 percent sales tax applies to retail sales made into Duluth.

Lakeville MN Sales Tax Rate. Edina MN Sales Tax Rate. Louis County - MN Minnesota - USA 55801.

Duluth MN Sales Tax Rate. Tax Return Preparation 1 BBB Rating. The Duluth sales tax rate is.

This is the total of state county and city sales tax rates. All Lodging establishments must collect 30 for the Lodging Excise Tax. Those with more than 30 units must also collect an additional 25 Lodging Tax.

340 S Lake Ave Ste 1 Duluth MN 55802-2359 - Read more on Tripadvisor You may also like. Minnesota department of revenue will administer this tax. If the items you are buying are for your personal use you can buy up to 770 worth of taxable items during the calendar year without paying use tax.

Duluth mn sales tax rate. The previous sales and use tax rate was 10 percent. Authorities said Osaka Sushi Hibachi Steak House used.

The use tax applies to taxable items used in the City if the local sales tax was not paid. This includes bars restaurants food trucks and retailers or others who sell prepared food or drinks. You can print a 8875 sales tax table here.

Mankato MN Sales Tax Rate. You can find more tax rates and allowances for Duluth and Minnesota in the 2022 Minnesota Tax Tables. 1 A basic 15 sales and use tax.

The Duluth City Council took its first steps Monday night toward imposing a half-percent tax on hotel stays and sales of food and drinks served at city restaurants and bars. 411 West First Street. This 15 percent sales tax applies to retail sales made into Duluth.

The minimum combined 2022 sales tax rate for Duluth Minnesota is. Contact Us Duluth City Hall. The City of Duluth remits a refund of City of Duluth Local Sales or Use Tax annually to eligible residents 65 years of age or older.

Name A - Z Sponsored Links. Duluth mn the twin ports and across the united states. Ad Find Out Sales Tax Rates For Free.

It has a sales price and average value of less than 3000. Single family home located at 328 s 57th ave w duluth mn 55807 on sale now for 182500.

2 Million Dollar Housesd Million Dollar Homes Multi Million Dollar Homes Dream House

Utah Sales Tax Exemptions Agile Consulting Group

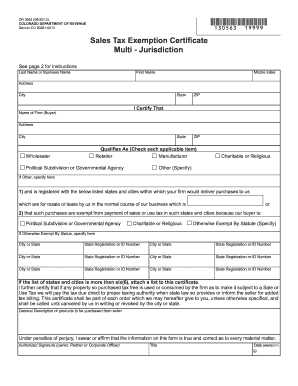

1994 Form Co Dor Dr 0563 Fill Online Printable Fillable Blank Pdffiller

Texas Sales Tax Exemptions Agile Consulting Group

Texas Sales Tax Exemptions Agile Consulting Group

1994 Form Co Dor Dr 0563 Fill Online Printable Fillable Blank Pdffiller

Texas Sales Tax Exemptions Agile Consulting Group

Washington Dc Sales Tax Exemptions Agile Consulting Group

Fill Free Fillable Minnesota Department Of Revenue Pdf Forms

Any Door News Forum Communications Printing

Glensheen S 7 5 Million Economic Impact Glensheen

2 Pizza Special Glass Nickel Pizza Co In Wisconsin

Georgia Sales Tax Rates By City County 2022

Minnesota Sales Tax Calculator Reverse Sales Dremployee

What Transactions Are Subject To The Sales Tax In Minnesota

Duluth T Shirt And Souvenir Shop Owner Imprisoned For Tax Evasion Bring Me The News